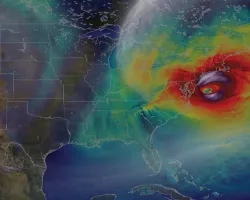

Disasters are expensive. Each year the world loses billions of dollars from damage to crops, buildings, infrastructure, and other assets. And these economic losses are on the rise. Climate change is fueling more frequent droughts, fires, floods, and severe storms. Development is also expanding into hazard-prone areas.

The insurance industry must keep up with these losses. To do so, they often turn to Earth observation data from NASA satellites and other remote sensing tools. This information helps insurers grasp the size of a disaster, better forecast risk, and give quicker payouts.

Protecting Vulnerable Communities

“Working with the insurance and financial sectors is critical for mitigating the impacts of disasters on the most vulnerable communities,” said Shanna McClain, the NASA Applied Sciences Disasters program manager. “Ensuring that these sectors have the best science improves the protections offered to communities around the world from a variety of hazards.”

The Disasters program area works with insurance companies, and reinsurance companies, too. Insurance companies need their own insurance. That’s where reinsurers come in. They help insurers reduce risk in the face of catastrophes that will involve huge claims.

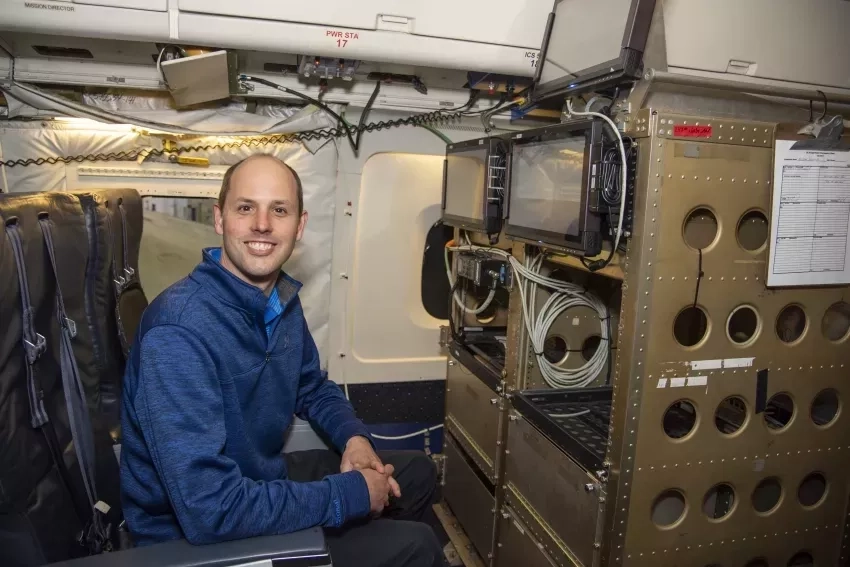

NASA has funded several research projects focused on understanding hazards to calculate risk. For example, hailstorms cause even more insured losses than tornados. And Kristopher Bedka, a research physical scientist at NASA Langley Research Center, helps the reinsurance industry characterize that risk.

Bedka is working with the firms Willis Towers Watson and Gallagher Re. Through this partnership, NASA satellite data helps determine the spatial extent of hail events and map the geographic distribution of the hazard. Though radar data is considered to be more accurate, satellite data can cover large areas at a consistently high spatial and time resolution.

“One key advantage of satellite data over ground-based information is the ability to study and compare locations across the globe over the very long time period that satellites have been operating,” Bedka said. “Areas that may be difficult to reach or sparsely populated can be studied using satellites. Hailstorm risk can be quantified with the same fidelity as other more accessible and populated areas. I have been surprised at how often hail occurs in areas such as South Africa, Bangladesh, Pakistan, and northwest Mexico. I would not have known about this without satellite data.”

With recent developments in artificial intelligence, the use of remote sensing data has become more sophisticated.

“Machine learning is helping us combine a wealth of data about storms,” Bedka said. "It helps us piece together patterns in satellite imagery. Combining the satellite observations and the storm environment information really improves the confidence in our hailstorm detections and risk assessments.”

Covering Risk for Farmers

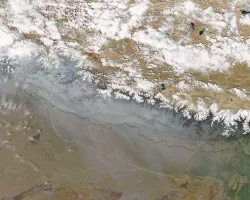

Satellite imagery provides data on weather, snow cover, soil health, and vegetation health. These are important factors for calculating risks to crops. In fact, agricultural insurance and climate risk is one of the main impact areas for the Applied Sciences Global Food Security and Agriculture consortium NASA Harvest.

“Agricultural losses have substantially increased in the past 30 years due to extreme weather events and a warming climate and are expected to further accelerate in the years to come,” said Program Director of NASA Harvest Inbal Becker-Reshef.

“Satellite data can help inform financial instruments, such as agricultural insurance and reinsurance," she said. "That information plays a key role in reducing vulnerability and increasing farm resiliency, including for many smallholder farmers in regions where insurance is currently not accessible to them.”

Sylvain Coutu is head of agriculture and nature re/insurance at the European-based firm AXA Climate. He has been involved with NASA Harvest as a data user since its inception. Coutu has seen firsthand how satellite data has helped provide coverage in regions where it was not possible before.

“The insurance and reinsurance businesses are quite risk-averse industries by nature,” Coutu said. “This means that we are often reluctant to cover risk in regions where we do not have data to understand what’s going on. Satellite data helped close this gap in almost all parts of the globe.”

Modelers must be very aware of climate trends to accurately forecast present-day risk. This is especially important since most insurance policies only cover the following 12 months. “Twenty years ago, the probability of having a frost event in certain regions was much higher than it is now,” said Coutu. “In such cases, if you calculate insurance for frost, it would not be fair to the farmers if I used temperature data from 20 years ago.”

Coutu said he often turns to NASA’s MODIS, which has more than two decades of data. He also uses imagery from the Landsat program. Landsat is a joint undertaking by NASA and the U.S. Geological Survey that began in 1972. It offers the longest continuous satellite record of Earth's land surfaces.

Meanwhile, newer instruments allow researchers look at the Earth in greater resolution. The recently launched SWOT mission from NASA and France’s space agency offers a look at Earth’s water in unprecedented detail. With SWOT data, researchers will have better measurements of sea level rise. They’ll also have a better look at associated inland flooding and saltwater intrusion, which can have important implications for food security.

Cutting Red Tape, Bouncing Back

Satellite data can help reduce administrative costs involved in traditional insurance, too. For instance a partnership between NASA and the U.S. Agency for International Development (USAID) called SERVIR focuses on locally led approaches to using Earth science data. In Kenya, a SERVIR project added satellite and other Earth science data into the tools that the national agricultural ministry uses to monitor crop conditions. In doing so, assessments for crop insurance took just one day instead of one week. The costs involved in the process dropped by 70 percent. The resulting savings allowed the project to expand to cover more farmers.

These collaborations also ensure that the correct insurance parameters are established before a disaster happens. Under some newer insurance schemes, a drought or flood of a certain severity will trigger automatic payouts of a set amount. And getting payments out quickly to the people who need them most can help prevent the long-term ripple effects associated with disasters.

“One of the biggest problems with earthquakes and hurricanes and other large disasters is that it takes money to get back on your feet,” said Charles Huyck. He is the executive vice president of ImageCat. The Long Beach, Calif.-based company brings remote sensing and satellite data into the process of catastrophe modeling. Its partnership with NASA Disasters has led to methods for identifying the potential for post-disaster economic disruption. This is key, as large-scale disasters can break a region's economic engine.

"When that happens, people can't go back to work," Huyck said. "They don't pay taxes. Eventually, people might have to move if too much of the infrastructure is damaged and workplaces are not up and running. The faster you get aid into an area, the faster they can recover, and the quicker the economic engine gets moving again.”

And if countries can insure for those losses, they can bounce back more quickly after disasters.

“But to do that, you have to have a realistic understanding of how long it will take to get back to normal,” Huyck said. "Remote sensing can help with that.”